From Design to Reality: Exploring the Power of Molded Plastics in Manufacturing

From Design to Reality: Exploring the Power of Molded Plastics in Manufacturing

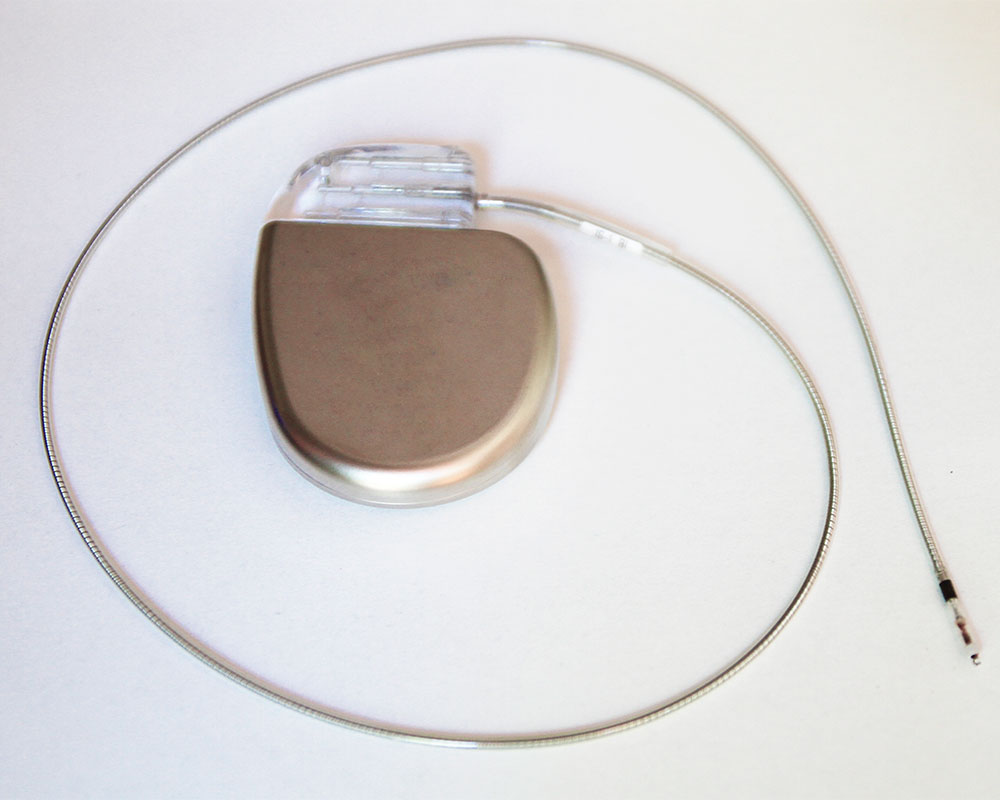

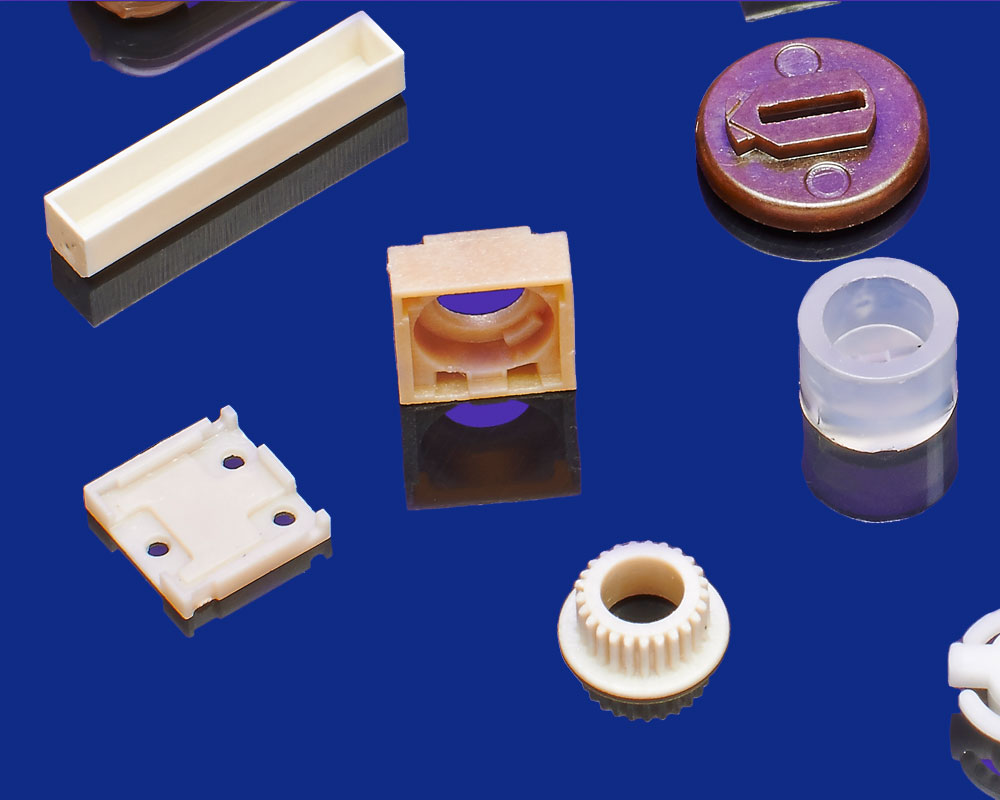

Transforming Medical Solutions With Medical Injection Molding Plastics: Meeting the Demands of Modern Healthcare

Injection Molding in Medical Technology: Pioneering Innovations for Safer Healthcare

Unlocking the Potential of Injection Molding Plastics

Revolutionizing Aerospace Injection Molding: A Leap Forward in Efficiency and Performance

Ten Injection Molding Tips

ProMed Pharma Press Release April 2022

DFM Checklist for Medical Manufacturing

Common Materials for Silicone Injection Molding